Understanding Market Trends: How to Make Informed Investment Choices

Understanding Market Trends: How to Make Informed Investment Choices

Blog Article

Maximize Your Returns With Diversified Financial Investment Profiles

In today's intricate economic landscape, making best use of returns through varied investment portfolios is not simply beneficial but crucial. A well-structured profile can effectively balance threat and benefit by dispersing financial investments across numerous possession courses and geographies.

Understanding Diversity

By integrating a range of financial investments, a capitalist can possibly boost returns while minimizing the impact of volatility. As an example, while equities may experience significant fluctuations, fixed-income safety and securities commonly supply security. Geographical diversity can protect a financier from localized financial declines, as various regions may grow or contract independently.

Effective diversity includes careful option and appropriation of possessions to guarantee a balanced direct exposure to take the chance of. An over-concentration in a single sector or property class can negate the benefits of diversity, increasing vulnerability to market changes.

Ultimately, comprehending diversification is crucial for capitalists seeking to construct durable portfolios. It urges a long-lasting viewpoint, highlighting the importance of readjusting allotments in response to altering market conditions, financial investment goals, and danger tolerance. This calculated approach cultivates a more secure investment atmosphere, conducive to accomplishing financial goals.

Trick Asset Courses to Consider

Equities, or stocks, provide the potential for capital appreciation and are essential for long-term growth. They can be more separated right into large-cap, mid-cap, and small-cap supplies, each offering varying levels of risk and return.

Fixed revenue financial investments, such as bonds, supply security and earnings through interest payments. They work as a barrier against market volatility, helping to protect resources while giving foreseeable returns.

Realty investments, whether through straight property possession or realty investment company (REITs), can offer diversity and prospective inflation defense - Investment. They normally display lower relationship with standard stock and bond markets

Last but not least, money or cash matchings, such as money market funds, provide liquidity and safety and security, making sure that investors can access funds when required. By integrating these key possession classes, financiers can produce a well balanced profile that straightens with their risk tolerance and monetary objectives.

Techniques for Constructing a Portfolio

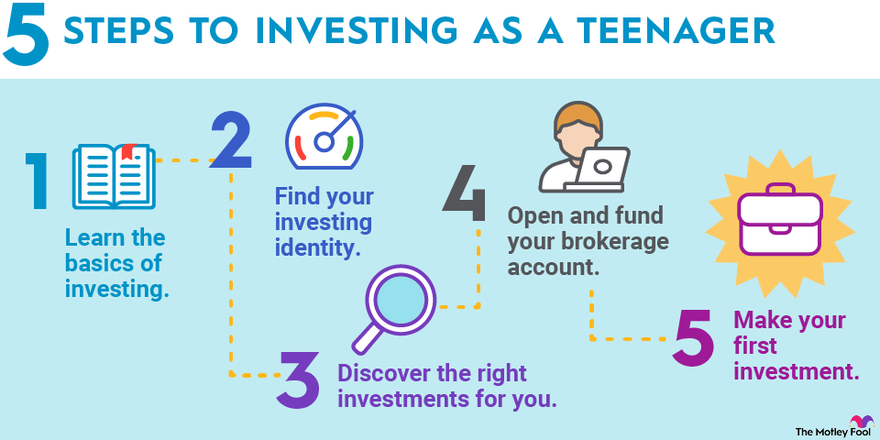

5 vital strategies can direct capitalists in developing a durable portfolio tailored to their one-of-a-kind economic goals and risk resistance. First, specify clear financial investment goals. Develop whether the focus is on resources growth, earnings generation, or a mix of both, as this will notify property allotment.

2nd, expand across possession courses. A mix of equities, fixed income, genuine estate, and different investments can minimize helpful hints danger and boost returns. Aim for a balance that straightens with your risk profile.

Third, think about geographical diversity (Investment). Investing in international markets can offer direct exposure to development opportunities while reducing domestic financial changes

4th, routinely evaluation and change your danger resistance. As life conditions change, so too ought to your portfolio. It's important to make sure that your financial investments continue to be aligned with your financial situation and goals.

Last but not least, capitalize on tax-advantaged accounts. Using pension or tax-efficient investment automobiles can enhance total returns by reducing tax obligation obligations. By executing these methods, capitalists can create a well-structured profile that not only meets their financial goals but also holds up against market volatility.

Tracking and Rebalancing Investments

Rebalancing entails adjusting the weights of numerous assets within the portfolio to recover the original or preferred allowance. This process not only manages risk however likewise permits investors to take advantage of market movements by offering acquiring and overperforming possessions underperforming ones, thus adhering to a self-displined financial investment technique.

Investors should establish a routine monitoring routine, such as quarterly or semi-annually, to examine their profiles. This regularity allows for timely adjustments while decreasing the influence of short-term market volatility. Additionally, substantial life events or adjustments in financial goals may demand a much more immediate rebalancing.

Eventually, consistent surveillance and go right here rebalancing encourage capitalists to maintain control over their portfolios, ensuring they stay lined up with their long-lasting purposes and take the chance of resistance, consequently taking full advantage of possible returns in a diversified financial investment landscape.

Common Blunders to Stay Clear Of

Capitalists typically come across numerous usual errors that can impede the success of their varied financial investment profiles. One common mistake is falling short to conduct thorough study before making investment choices.

Another typical mistake is neglecting to frequently review and rebalance the profile. Market fluctuations can modify the initial possession allotment, and falling short to change can undermine diversification advantages. Psychological decision-making additionally poses substantial dangers; investors might respond impulsively to market volatility, leading to early sales or missed chances.

Moreover, concentrating as well heavily on previous efficiency can be misleading. Because a possession has actually executed well traditionally does not assure future success, just. Last but not least, ignoring charges and expenses can wear down returns with time. Understanding transaction expenses, administration charges, and taxes is essential for maintaining a healthy and balanced portfolio. By avoiding these common mistakes, financiers can enhance the performance of their varied investment strategies and work towards achieving their financial objectives.

Verdict

In conclusion, the application of a diversified financial investment portfolio works as a critical method for handling threat and enhancing returns. By alloting assets across different courses and geographies, financiers can reduce prospective losses while maximizing diverse market opportunities. Normal tracking and rebalancing more make sure alignment with monetary purposes, therefore promoting stability and strength. Eventually, embracing a varied approach not only targets capital recognition but likewise fortifies the financial investment framework against market volatility.

A well-structured portfolio can effectively stabilize threat and reward by distributing investments across various possession classes and locations.Regularly keeping track of and rebalancing financial investments is vital for keeping a profile's placement with an investor's objectives and run the risk of resistance. Over time, market variations can create an investment portfolio to wander from its intended asset allotment, leading to unintended exposure to take the chance of or missed opportunities for development.Capitalists often come across a number of typical errors that can hinder the success of their diversified financial investment profiles.In conclusion, the execution of a diversified investment portfolio serves as a vital approach for taking care of danger and boosting returns.

Report this page